Contents

Between 74-89% of retail investor accounts lose money when trading CFDs with this provider. Between 74-89% of retail investor accounts lose money when trading CFDs with this broker. FP Markets Review Canada – FP Markets is one of Australia’s leading CFD and Forex brokerages, the operation is concerning abundant, much more.

- I have felt it most beneficial with short-term trading or hedged positions.

- In addition, FP Markets provides access to stock and commodity markets during their pre-open and pre-close phases.

- Should you ever need to trade again I would be happy to leave my contact details with you, both email and direct line, to pick this up on his behalf.

- For cash Managers, the MAM/PAMM accounts square measure doubtless terribly helpful.

First Prudential Markets offers some of the industry’s tightest spreads. With this broker, you can trade from 0.0 pips on major currency pairs. Commission-wise, forex traders will pay $6 per lot per round turn, while those trading shares will pay 0.1% (AUD$10 minimum). Finally, with respect to customer service, it is hard to give anything negative for this product. The customer service support is prompt and efficient, and the web trading platform is fast and easy to use.

FP Markets Account Types

Customer support – FP Markets’ multi language customer support service is available 24 hours, 5 days a week, in 15 languages. FP Markets’ support is available via global phone numbers , email, contact form and live chat directly from the broker’s website. FP Markets has MAM/PAMM accounts alternatives for money managers. We trade the ASX, US markets, London, Frankfurt, Hong Kong and Singapore all in IRESS as well as FX, indexes and commodities in MT4. If you have anything you would like to trade in these markets I will assist.

FP Markets is seemingly a goldmine, because they have a lot of assets to offer – especially in the Forex department – at tight spreads. But, as you’ve seen, their spreads aren’t always tight and you can subsequently lose a lot of your money to this provider. FP Markets mainly uses the ECN system to set up their brokerage. From the technical side, it means you’ll be connected to your end buyer or seller much faster and with little hindrance, to simplify the process. Factually, these systems offer tighter spreads per deals, but you’ll be paying more commission to your broker.

It is important to note however, that the Blue book is an “ever-evolving” document and as such, reflects changes in the manner the different items are traded on the market. This means that at any moment, there may be a completely different set of trade values for the same items. This is why it is important to ensure you are comparing apples-to-apples when looking at the differences between the three different sources of data.

Annual returns from this account are also tax-sheltered, earnings will be taxable in the hands of the beneficiary upon withdrawal. However, the tax rate for beneficiaries is often nil or low. The accuracy of the calculation of taxes payable is essential and must take into account the different tax brackets rather than an average rate. With the current turmoil in the financial markets, a return to basics can reassure you. Will you trade a Turkish Lira to a Hungarian Forint at several hundred pips of average spread?

Since it’s an Australian company, Fusion Markets isn’t regulated by Canadian regulatory institutions. You can sign up for a demo account to familiarize yourself with MetaTrader 4 without putting any real money on the line. You won’t have to load a minimum balance into your account to start trading. It’s easy to open an account in a matter of minutes using Fusion Markets‘ online application. Access a number of advanced charting tools with technical indicators and line studies to help accurately project your trades.

They are, for all intents and purposes, an Australian provider. However, they have expanded so much, people from all over flock to their services. They’re regulated by ASIC (Australian Securities & Investment Commision) in Australia that incorporates a traditionally sturdy culture of company governance.

If you do trade with us in the future we could also offer you a $200 trading credit to get you started. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. CSI Podium offers designation holders opportunities to speak on topics to benefit their clients, colleagues, and the investing public via webinars. Get $50 in free trades when you fund your account with a minimum of $1,000. Fusion Markets offers some of the best rates available so that more of your profit goes directly into your pocket. Trade currency pairs to take advantage of small fluctuations in global exchange rates.

FP Markets Review

FP Markets provides Direct Market Access to thousands of financial instruments over an Electronic Communication Network . It passes your orders onto liquidity providers over a fibre-optic cable to ensure the fastest possible execution speeds. All market orders flow directly through to the best bid or offer price without any dealer intervention.

Being an Australian licensed forex broker, the client’s interests are a priority for them. With their firm commitment to excellence, FP Markets are one of the leading forex brokers in Australia. First Prudential Markets Pty Ltd is an Australian-regulated broker offering traders access to a full suite of CFDs across forex, equities, indices, metals, commodities and cryptocurrencies.

Master financial planning skills with the ISO and FSRA-certified Personal Financial Planner (PFP®) designation. Explore continuing education courses and meet your requirements for CSI, IIROC, CSF and other professional associations or certifications. You’ll need to be tech-savvy to schedule https://broker-review.org/ trades or to set up stop losses as well as stop and limit orders. You’ll get $150 for both you and a friend if you recommend they use Fusion Markets and you both set up an account and start trading. Trade products such as gold, silver, zinc, copper, platinum and other precious metals.

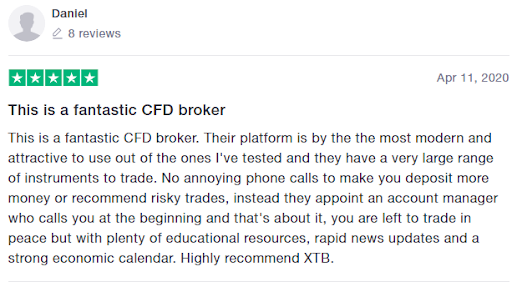

Very happy with the team at FP Markets, and hope to be with them for years to come. We appreciate the positive review – we understand it’s a competitive industry so will never allow ourselves to become complacent. Great you’ve had a good experience with us and we will ensure you always will for many years to come. The commission is pretty low compared to the other platforms. It goes against our guidelines to offer incentives for reviews.

In the ECN RAW account, however, the broker offers the market spreads of the interbank market and charges a commission of 3.5 dollars per 100,000 dollars traded, per half-turn. The broker is certainly not one of the cheapest forex providers, but the prices for forex trading are still within a good framework. First Prudential is a CFD and forex broker with a lot of longevity in the industry.

The Forex Megadroid – Best Rated Trading Program of Its Type

Even though mobile trading is now standard, most brokers don’t have their own mobile trading platform, but rather use people who they also offer. MetaTrader 4 and MetaTrader are the foremost popular trading platforms for private customers. The two trading platforms are complemented by IRESS, another trading software that would be a good alternative for anyone who isn’t satisfied with the MetaQuotes software. For more information, please visit the FP Markets deposit and withdrawals dedicated page.

For this reason, FP Markets client’s funds are kept in top-tier international banks, fully segregated from the company’s funds. In addition to the various trader features listed above, another high point of FP Markets is its reliability. It uses several well-liked, highly-rated platforms, including MetaTrader 4, MetaTrader 5, WebTrader, and Iress.

FP Markets Support

With respect to trading on the two account types, if you prefer to limit your risk, the manual setting will be perfect for you as the robot will only enter trades when you allow it. Pepperstone offers ultra-tight spreads through both its standard commission-free account and its ECN-style razor account. Forex news The average spreads of the top brokers shown below are taken straight from the broker’s websites and updated monthly.

During withdrawals, a maximum amount must be respected annually. It is therefore recommended to check the relevance of setting up an unlocking plan. This account is the result of the transfer of a pension plan from a fp markets review former employer into an investment account. This account includes a tax incentive in the form of a deduction on the contribution made. You even have the flexibility to choose in which year you will use the deduction.

Overall, the traders’ feedback we’ve seen has been massively positive. At fpmarkets you’ll trade Forex and CFDs, among other things. MetaTrader 4 and MetaTrader 5 are in fact also available as trading apps. The apps also are very popular and are the first choice for several traders as well as in the browser or desktop version. Mobile trading is extremely popular with most CFD and Forex traders. For many trading strategies it is sensible to permanently monitor the open positions and to be able to close them at any time.